Q1 2025 SuperStars

Congrats to our Q1 Superstars!

Q1 #1 in Sales Volume-Cameron Griggs

Q1 #1 in Listings-Brook Sparks

Q1 #1 in Units-Emily Bray

Q1 #1 Team in Listings & Units Sold The Heather Sakers Team

Q1 #1 Team in Listings The Heather Vandermyde Group

Earth Day 2025

Earth Day: Celebrating Our Planet and Taking Action for a Sustainable Future

Every year on April 22nd, millions of people across the globe come together to celebrate Earth Day, a day dedicated to raising awareness about environmental issues and inspiring action to protect the planet. Since its inception in 1970, Earth Day has grown into a global movement, with individuals, communities, businesses, and governments all playing a role in shaping a more sustainable world.

The Origins of Earth Day

Earth Day was founded by U.S. Senator Gaylord Nelson in response to a growing concern over environmental degradation. At the time, air and water pollution were major public concerns, and the use of pesticides was leading to significant harm to wildlife and ecosystems. The first Earth Day, held in 1970, sparked nationwide environmental protests, led to the creation of the Environmental Protection Agency (EPA), and helped to pass important environmental legislation, such as the Clean Air Act and Clean Water Act.

What started as a national movement soon turned into a global initiative, as people from all walks of life began organizing to fight for environmental protection. Today, Earth Day is celebrated in more than 190 countries, and its influence is more powerful than ever.

Why Earth Day Matters

Earth Day serves as an important reminder that our planet is fragile, and its resources are finite. From climate change and deforestation to pollution and biodiversity loss, the world faces numerous environmental challenges. Earth Day is an opportunity to take stock of our impact on the environment, reflect on the changes we can make, and take collective action to reverse some of the damage we’ve done.

On Earth Day, we’re not just celebrating nature; we’re advocating for its protection. This day serves as a call to action to reduce our carbon footprint, conserve water, support renewable energy, and protect wildlife habitats. It also encourages us to shift our mindset from one of consumption to one of sustainability, recognizing that small changes in our everyday lives can have a significant, long-term impact on the planet.

How You Can Make a Difference

While Earth Day may only come once a year, the need to care for the environment is a year-round responsibility. Here are some ways you can make a positive impact, not just on Earth Day, but every day:

-

Reduce, Reuse, Recycle: Be mindful of your consumption patterns. Reduce waste by purchasing items with less packaging, reusing materials when possible, and recycling whenever you can.

-

Plant Trees: Trees are vital to our ecosystem, providing oxygen, improving air quality, and supporting biodiversity. Planting trees or supporting reforestation projects is an easy and impactful way to contribute to a healthier planet.

-

Save Energy: Turn off lights when not in use, unplug electronics, and consider energy-efficient appliances. Even simple actions like using natural light during the day can make a difference.

-

Support Renewable Energy: Advocate for and support policies that encourage the use of renewable energy sources like solar and wind. If possible, consider switching to a green energy provider.

-

Get Involved in Local Environmental Initiatives: Volunteer with local environmental organizations, participate in clean-up events, or support community gardens. Local actions can have a big impact on the health of your surrounding environment.

-

Educate Yourself and Others: One of the most powerful tools we have is knowledge. Learn more about environmental issues, and share that knowledge with others to inspire more widespread action.

-

Support Sustainable Products: Choose products that are eco-friendly, from clothing to food to household goods. Look for certifications like Fair Trade, USDA Organic, or Energy Star to ensure that what you’re buying is helping, not harming, the planet.

Outer Banks Earth Day Events

Earth Fair-Earth Day Celebration Jockey’s Ridge

April 22 @ 1:00 pm – 4:00 pm

More information

Come celebrate Earth Day with the Coastal Environmental Educators Network. This free event will take place at the Jockey’s Ridge State Park visitor center parking area. The event will bring together many Outer Banks organizations that offer environmental education, so you’ll be sure to learn something new from the groups that are working hard to preserve the delicate ecosystems of the Outer Banks. Share your love for the natural world and check out our fun and informative exhibits and activities for kids. Walk around and explore the exhibitors, state-of-the-art Visitors Center, and other features of the State Park!

Earth Day & Plant Swap

Saturday April 26th 10-1pm

Saturday April 26th 10-1pm

RWS Community Building

More Information

The third annual Earth Day Celebration and Plant Swap. Come visit members and organizations, Cape Hatteras Electric Cooperative (with their electric vehicle), Hatteras Library, Surfrider Federation, NPS, NC Cooperative Extension, Master Gardeners and more.

Conclusion

Earth Day is more than just a symbolic day of recognition; it’s a movement that reminds us of our interconnectedness with nature and our responsibility to protect it. As we face environmental challenges that threaten the future of our planet, Earth Day is a time to reflect on what we can do to make a difference.

So this Earth Day, take a moment to appreciate the beauty and wonder of the planet we call home—and then take action. Small steps, when taken by many, can create a world of change. The future of our planet depends on what we do today, and together, we can build a more sustainable and equitable world for generations to come.

Happy Earth Day! 🌍

Easter Family Events on the Outer Banks

Outer Banks Easter events that are perfect for the entire family

The Easter holiday is a popular time for many families to visit the Outer Banks, as it usually coinsides with Spring Break. Locals embrace the change of pace and more visitors and everyone welcomes the warmer temperatures! We have complied a list of some not-to-miss Easter events-perfect for the whole family to enjoy!

Easertide at Elizabethan Gardens

April 19th 10am-2pm

www.elizabethangardens.org

Kitty Hawk Kites Easter Eggstravaganza

April 19th 10:30am-1:15 pm

www.kittyhawk.com

Fly Into Spring Kite Festival-Jockey’s Ridge State Park

April 18-19th, 2025

www.kittyhawk.com

Happy Easter from the Coldwell Banker Seaside Realty Team!

Outer Banks Taste of the Beach

Outer Banks Taste of the Beach April 4-6, 2025

Mark your calendars for the Outer Banks Taste of the Beach Weekend! This year, the event will be held April 4-6 with participating restaurants from Currituck County, as north as Duck, NC-all the way south to Hatteras Island! Taste and sip your way through this popoular Outer Banks spring event.

Outer Banks Taste of the Beach Participating Restaurants:

Barefoot Bernie’s

Basnight’s Lone Cedar Cafe

Black Pelican Seafood Co

Dirty Dick’s Crab House

Good Winds Restaurant

Hurricane Mo’s

Jolly Roger Restaurant

Lost Colony Tavern

NC Coast Grill & Bar

Outer Banks Brewing Station

Red Sky Casual Dining

Roadside Bar & Grill

Sanctuary Vineyards

Sandtrap Tavern

Shipwrecks Taphouse & Grill

Shore Coffee Roasters

Simply Southern Kitchen

Swellsa Brewing Duck Dive Bar

The Saltbox Cafe

TRIO

Outer Banks Holiday Events

It’s the most wonderful time of the year! Whether you are an Outer Banks resident full-time or part-time or a visitor, Coldwell Banker Seaside Realty has your guide to holiday happenings in the area.

From local restaurant events, holiday markets, parades, lights, Santa Claus appearances and more, our Outer Banks Holiday Events list continues to grow-check back often!

Outer Banks Holiday Events

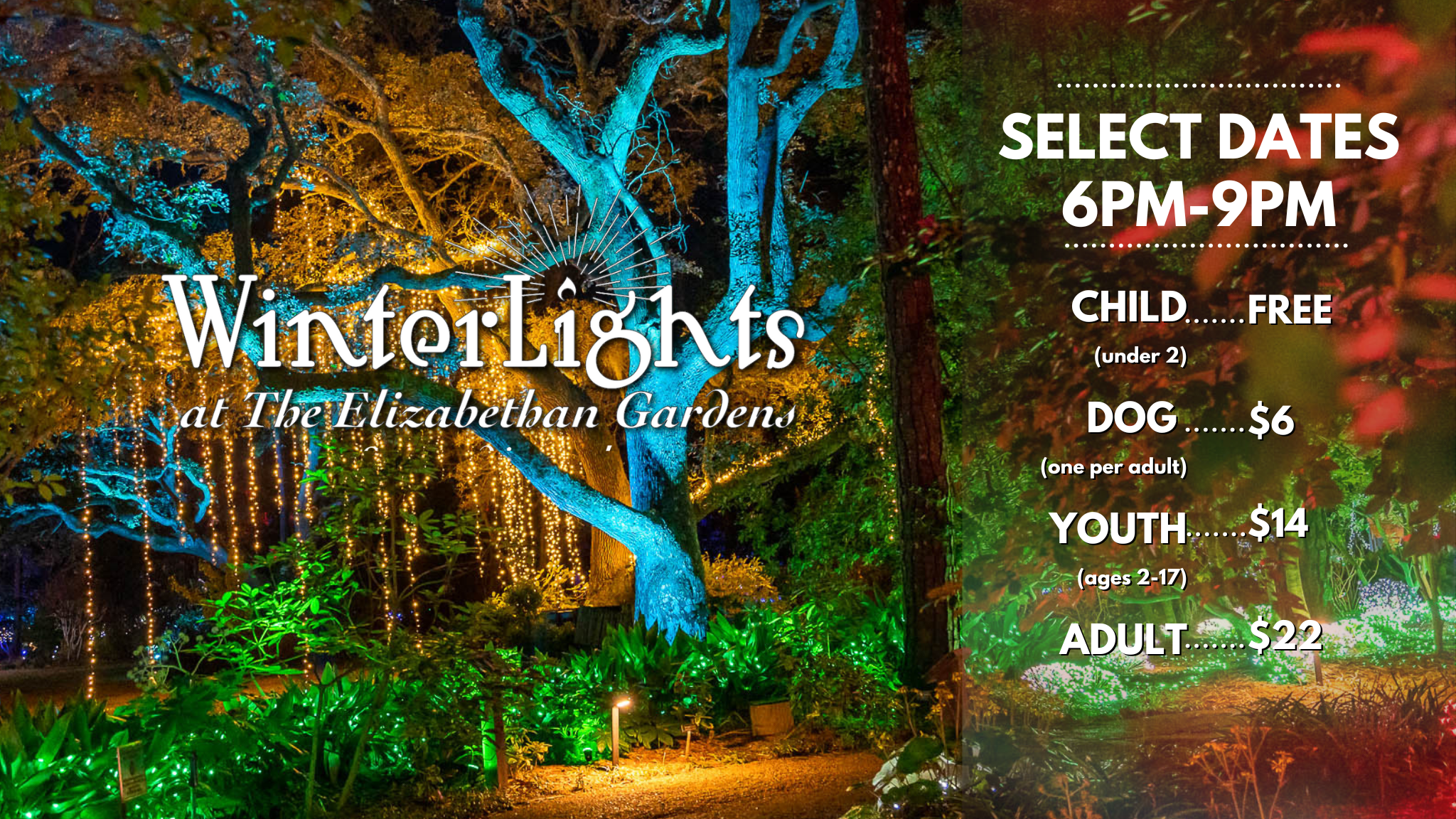

WinterLights at The Elizabethan Gardens- November 22-December 28, select nights. The 15th annual draw-dropping light display is one not to miss. The 10 acre botanical gardens is transformed into a Winter Wonderland!

Adults: $22, Children under 17: $14, Pet Friendly

More Information: www.elizabethangardens.org

Kites With Lights at Jockey’s Ridge Presented by Kitty Hawk Kites-November 30th, 2024. From 4 – 7 PM, experience a light display like no other. Kites with Lights, at Jockey’s Ridge State Park, features large 19-to-30-foot kites decked out in the spirit of the holiday season! At 5 PM, enjoy the lighting of the Jockey’s Ridge State Park Solar Christmas tree out on the dunes directly across from Jockey’s Ridge Crossing. Warm beverages are available across the street at Jockey’s Ridge Crossing. All donations benefit the Friends of Jockey’s Ridge.

Hangin’ with Santa-Kitty Hawk Kites-Nags Head. Share all your Christmas wishes and have your picture taken with Santa at Kitty Hawk Kites at Jockey’s Ridge Crossing in Nags Head on Friday, November 29th from 10 AM – 2 PM, and Saturday, November 30th from 1 – 4 PM.

More information: www.kittyhawk.com

The 12 Bars of Christmas-Opening November 29th. 12 festive pop-ups, fully decked out in holiday cheer! More details can be found here: 12barsofchristmas.com

Theatre of Dare Presents: Yes, Virginia, There is a Santa Claus-A young girl writes a letter to the editor of the New York Sun. “Dear Editor, I am eight years old. Some of my little friends say there is no Santa Claus. Papa says if you see it in the Sun, it’s so. Please tell me the truth. Is there a Santa Claus?” Ed Mitchell, the editor, assigns Frank Church—a reporter on the verge of self destruction—the task of answering Virginia’s question. Church’s quest and reply have become one of the world’s most quoted and beloved editorials. Radio Drama by Andrew J. Fenady, Directed by Gail Hutchison.

Performances: December 7, 12, 13 & 14 at 7:30 p.m.

December 8 & 15 at 2:00 p.m. Individual show tickets go on sale November 16

View more information here:Visit Website

Holiday Markets:

Soundside Holiday Market at the Soundside Event Site in Nags Head-11/24, 12/1, 12/15 12PM – 4PM

Featuring photos with Santa Claus, an appearance (or two) from the Grinch, a live camp fire to keep your hands and toes warm, Christmas tunes to sing along to, food trucks AND 60+ of your favorite Outer Banks local makers and artisans will offer a little something for everybody.

First Flight Holiday Market-Aviation Park, KDH-Get ready to shop, eat, and experience all the festive fun because the holiday markets are officially starting soon! From handmade gifts to delicious treats, community vibes to holiday music, there’s something for everyone at our markets! Don’t miss out—mark your calendars, grab your friends, and get ready to shop, snack, and spread cheer!

First Flight Holiday Market-Aviation Park, KDH-Get ready to shop, eat, and experience all the festive fun because the holiday markets are officially starting soon! From handmade gifts to delicious treats, community vibes to holiday music, there’s something for everyone at our markets! Don’t miss out—mark your calendars, grab your friends, and get ready to shop, snack, and spread cheer!

More information: Visit Website

Coldwell Banker Seaside Realty wishes you and your family a wonderful holiday season-full of cheer!

Check back often for updates on local OBX Holiday Events!

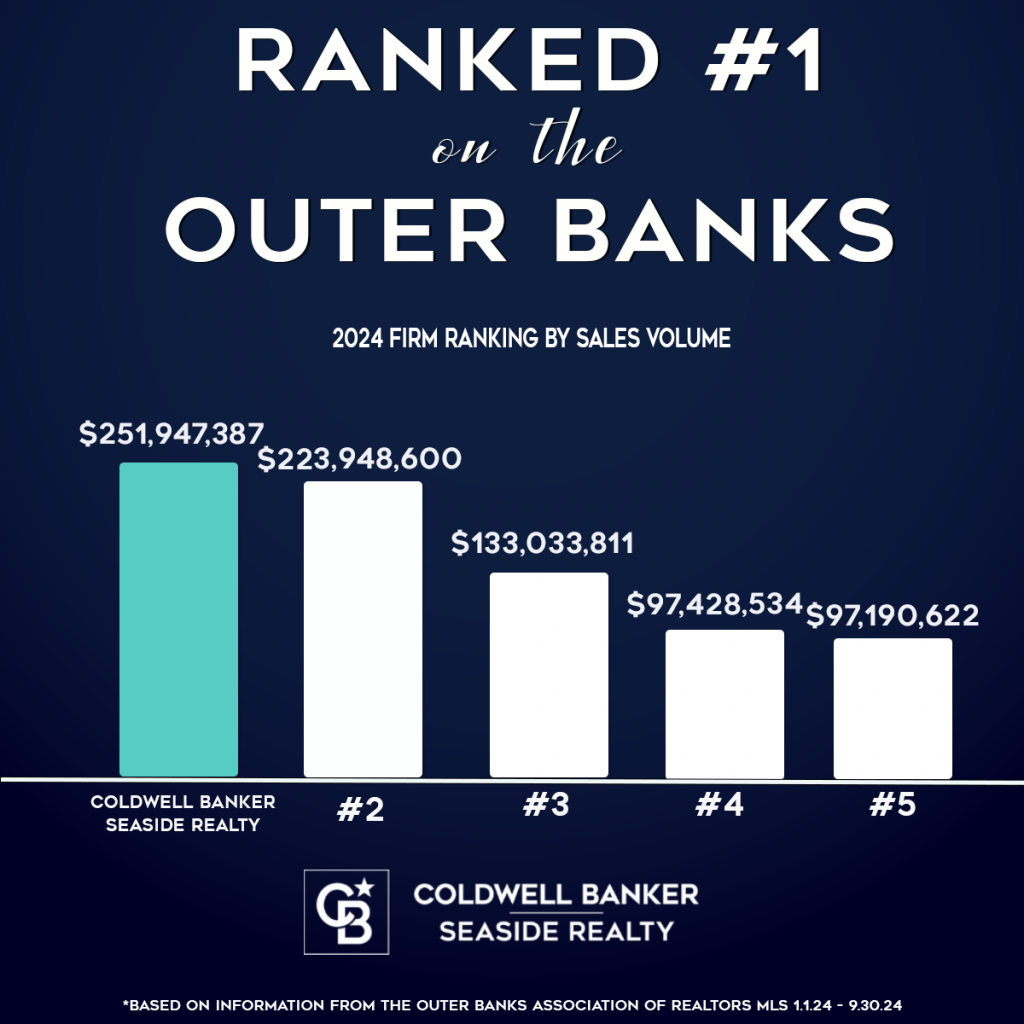

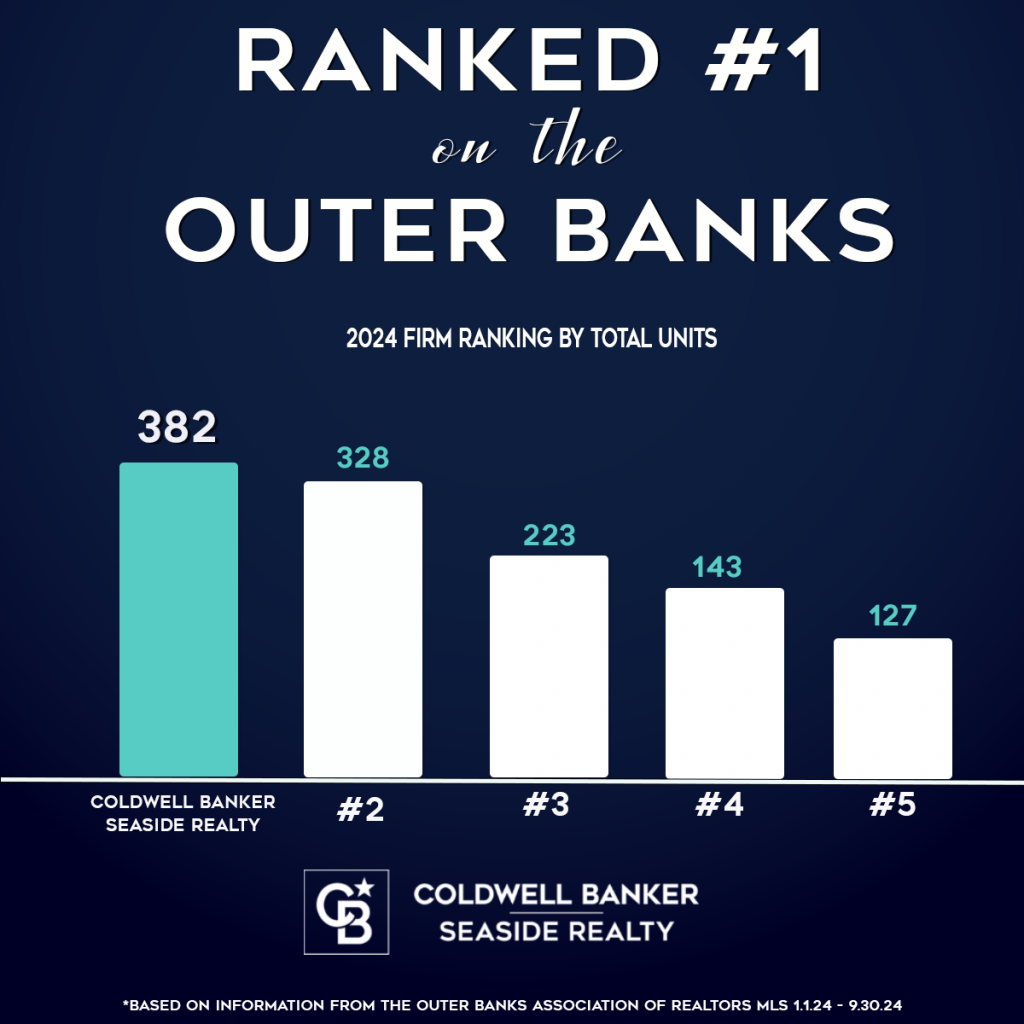

2024 Outer Banks Real Estate Q3 Results

Coldwell Banker Seaside Realty is proud to be leading the Outer Banks real estate market for the third quarter of 2024!*

Q3 2024 Ranking by volume:

Coldwell Banker Seaside Realty | $251,947,387

Q3 2024 Ranking by units sold:

Coldwell Banker Seaside Realty | 382

Coldwell Banker Seaside Realty Q3 Super Stars

*Based on information provided by the Outer Banks Association of Realtors. 1/1/24-09/31/24.

**Based on information provided by the Outer Banks Association of Realtors. 1/1/14-09/31/24.

Pamela Smith Promoted to President

𝐂𝐨𝐧𝐠𝐫𝐚𝐭𝐮𝐥𝐚𝐭𝐢𝐨𝐧𝐬 𝐭𝐨 𝐏𝐚𝐦𝐞𝐥𝐚 𝐒𝐦𝐢𝐭𝐡 𝐨𝐧 𝐛𝐞𝐢𝐧𝐠 𝐧𝐚𝐦𝐞𝐝 𝐂𝐁 𝐒𝐞𝐚𝐬𝐢𝐝𝐞’𝐬 𝐧𝐞𝐰 𝐏𝐫𝐞𝐬𝐢𝐝𝐞𝐧𝐭 𝐚𝐧𝐝 𝐩𝐚𝐫𝐭 𝐨𝐰𝐧𝐞𝐫.

Coldwell Banker Seaside Realty congratulates Pamela Smith, formerly the Vice-President, on her recent promotion to President and part owner of the Outer Banks firm.

“I am honored to work with the best family, the best company, the best brand, and the most exceptional agents and management team. I am looking forward to continuing to lead Coldwell Banker Seaside Realty as President! What’s not to love about my job?”-Pamela Smith.

Upcoming August Events on the OBX

Summer may be winding down, but there are still great events happening during the month of August!

August Events on the OBX

Soundside Summer Markets

Explore the vibrant spirit of our community at Soundside Market in Nags Head. Dive into a world of unique handmade treasures, lovingly crafted by local artisans. By shopping here, you not only acquire one-of-a-kind pieces but also lend a helping hand to small businesses at the heart of our community. Join us in celebrating local creativity and craftsmanship at the Soundside Market.

https://www.facebook.com/

The Lost Colony

Discover America’s Oldest Mystery on the OBX! The 87th season of The Lost Colony runs from May 30-August 24th, 2024.

Buy Tickets: www.thelostcolony.org

Vusic OBX Music Festivals Summer Series-All concerts are held at the Roanoke Island Festival Park.

View upcoming concerts here.

WRV Outer Banks Pro- August 28 to September 1 at Jennette’s Pier in Nags Head. The WRV Outer Banks Pro, is a premier surfing event sanctioned by the World Surf League (WSL).

View more information.

Elizabethan Gardens Butterfly Release-Tuesdays and Thursdays, discover butterflies up-close as they take their first flight!

View more information.

For more events happening all year long on the Outer Banks, visit www.outerbanks.org.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link