Holiday Events on the OBX | Week of 12.15.25

Your OBX Holiday Happenings: December 15 – 21, 2025

Coldwell Banker Seaside Realty’s Guide to Festive Fun Across the Outer Banks

The holiday magic is in full swing on the Outer Banks! Whether you’re a local looking for family activities or a visitor planning your winter getaway, there’s something for everyone this week. From festive markets to historic celebrations and themed pop-ups, here’s what’s happening around town.

Monday, December 15

The 12 Bars of Christmas (Multiple Locations)

The ever-festive 12 Bars event continues! Pop into themed holiday bars across Kill Devil Hills, Nags Head, and Manteo for seasonal drinks, cozy vibes, and passport prizes.

Misfit Bars Holiday Events

From Holiday Trivia at Trio to A Coastal Christmas Wine Dinner at The Saltbox Cafe, local venues are hosting themed gatherings perfect for date nights or meetups with friends.

Tuesday, December 16

Santa at Kill Devil Grill

Catch Santa from 5 – 8 p.m. and enjoy seasonal vibes, great food, and fun for families and friends alike.

Wednesday, December 17

Celebration of the Wright Brothers First Flight (Kill Devil Hills)

A special Wright Brothers Day commemorates the anniversary of the first successful powered flight. Activities and historical moments take place at the Wright Brothers National Memorial (9 a.m. – 5 p.m.). Admission is FREE to the Wright Brothers National Memorial All Day.

Aquarist for a Day (North Carolina Aquarium, Manteo)

Get up close with marine life and learn from aquarium staff in this interactive experience — a great family-friendly opportunity to explore local wildlife.

Dinner With the Grinch (Jolly Roger Restaurant)

Cap the day with themed dinner fun from 4 – 7 p.m. — perfect for kids and adults with a playful holiday twist.

Dowdy Park Candy Cane Hunt-December 17th, 2025 5-6pm

Bring the family and join us at Dowdy Park for a festive Candy Cane Hunt! Kids will have a great time searching for hidden sweet treats in this fun holiday tradition. Don’t forget your holiday spirit, a flashlight, and your best candy cane hunting skills! The hunts will be divided into two age groups.

December 19th 2025

First Flight Holiday Market-Aviation Park, Kill Devil Hills-3pm-7pm

Get ready to shop, eat, and experience all the festive fun because the holiday markets are officially starting soon! From handmade gifts to delicious treats, community vibes to holiday music, there’s something for everyone at our markets!

Don’t miss out—mark your calendars, grab your friends, and get ready to shop, snack, and spread cheer!

December 20th, 2025

First Annual Holiday Market-Christmas Shop, Manteo

We’re decking the halls and can’t wait to host our very first Christmas Market on Saturday, December 20th from 10:00 AM – 3:00 PM! The Market will take place outside the General Store in the outdoor courtyard.

Want more ideas for things to do during your visit or are you thinking about making the OBX your home? Reach out to Coldwell Banker Seaside Realty — we’d love to help you find the perfect property or make the most of your Outer Banks stay!

Holiday events on the OBX Week of December 8, 2025

Holiday Happenings on the Outer Banks

The week of December 8, 2025

The holiday season is in full swing on the Outer Banks, and this week is packed with festive events, twinkling lights, and plenty of coastal holiday cheer. Whether you’re a local, a visitor, or dreaming of making the OBX your home, there’s no better time to experience the magic of winter at the beach.

WinterLights at The Elizabethan Gardens – Manteo

Stroll through one of the most beloved holiday traditions on the Outer Banks as The Elizabethan Gardens transform into a glowing wonderland of lights, decorations, and seasonal displays. This family-friendly event is perfect for an evening walk under the stars and runs on select nights throughout December. View the website for dates.

Santa & Community Holiday Events

Throughout the week, several towns across Dare County will host visits with Santa, family festivals and small community celebrations. These events are a wonderful way to enjoy the simple charm of the Outer Banks during the holidays and create lasting family memories.

Holiday Pop-Up Bars, Events & Seasonal Menus

Local restaurants and bars are embracing the season with festive pop-ups, themed cocktails, and special holiday menus. From cozy Christmas décor to creative seasonal drinks, it’s the perfect way to warm up after a winter beach walk.

- Meet the Grinch at 1903 Bar & Kitchen, December 10th, 2025 5pm-7pm

- Pony Cart Rides with Santa at Jolly Roger Restaurant, December 10th, 2025 4-7pm.

- Ugly Sweater Holiday Restaurant Crawl, December 12-14 at the following restaurants:

Shipwrecks Taphouse & Grill, Black Pelican, Hurricane Mo’s and 1903 Bar & Kitchen - Shipwrecks Winter Fest, December 13th, 3pm-8pm at Shipwrecks Taphouse & Grill

Pony rides, gingerbread house making, photos with Santa and more. - 12 Bars of Christmas-Check out the website for all participating restaurants and events here.

Holiday Markets & Shopping

Support local small businesses at holiday markets happening across the Outer Banks this week. Shop for handcrafted gifts, coastal décor, artwork, ornaments, and unique finds while enjoying live music and a cheerful atmosphere.

Soundside Holiday Market-December 14th, 2025 at the Nags Head event site from 12-4.

Experience the Outer Banks Year-Round

One of the best things about life on the Outer Banks is that the sense of community never disappears—especially during the holidays. From quiet beach mornings to festive town events, winter is truly a special time to live and invest here.

At Coldwell Banker Seaside Realty, we don’t just help you find a house—we help you discover the lifestyle that comes with it. If you’re thinking about buying, selling, or investing on the Outer Banks as we head into 2026, our local experts are here to help every step of the way.

Christmas events on the OBX | Week of December 1st, 2025

What’s Happening This Week — Christmas Events on the Outer Banks

If you’re on the Outer Banks this week, there are so many festive events going on — from cozy historic holiday celebrations to tree-lightings, markets, and parades. Here’s a roundup of recommended events to help you catch the holiday spirit 🎅

🌟 Highlights of the Week

Manteo Christmas Tree Lighting — Friday, December 5, 2025

-

When: Friday, December 5 — 6:00 PM ✨

-

Where: Manteo Waterfront / Downtown Manteo

-

What to expect: Hot cocoa and fire pits, holiday music, lights, and maybe even a visit from Santa! The event kicks off with kids’ activities and a Gingerbread House contest at Magnolia Pavilion starting 4:00 PM.

-

After the tree lighting: enjoy a holiday market, ornament decorating, children’s crafts, and caroling — a festive evening for the whole family.

Parade & Old-Time Holiday Charm: Manteo Christmas Parade — Saturday, December 6, 2025

-

Time: Parade starts at 10:30 AM.

-

What to expect: Floats, marching bands, community groups — and Santa making his way through Downtown Manteo.

-

Tips: Parking is available at College of The Albemarle – Dare Campus and Manteo Elementary, with free golf-cart shuttles running.

🕯️ Historic Holiday at Christmas Past (at Island Farm, Roanoke Island) — Friday & Saturday, Dec 5–6, 2025

-

Dates & Time: December 5 & 6 — 2:00 PM to 7:00 PM

-

What it is: A charming, low-key way to celebrate — experience what Christmas looked like in the mid-1800s on Roanoke Island. There will be candlelit historic homes, traditional decor, musket firing, hot cider, holiday treats, wreath/ornament crafting, and visits with St. Nicholas.

-

Admission: $11 (ages 4 and up); free for children under 4.

This week captures a wonderful mix of traditions and community spirit — from the historic charm of candle-lit homes at Island Farm to the cheerful small-town gatherings in Manteo and Duck. Whether you want to buy unique gifts from local artisans, make holiday memories with family, or simply enjoy the glow of Christmas lights along the calm OBX coast — there’s something for everyone.

Third Quarter OBX Superstars

Congratulations to our Third Quarter SuperStar Agents at Coldwell Banker Seaside Realty! Your hard work, dedication, and exceptional service continue to raise the bar across the Outer Banks. We’re proud to celebrate your outstanding achievements and the commitment you bring to helping clients navigate the local real estate market with confidence. Thank you for representing our team with professionalism, passion, and true OBX spirit. Here’s to continued success!

Team: The VanderMyde Group

Agent: Cameron Griggs

Team: The Heather Sakers Team

Agent: Haley Winslow

CBSR Donates to Outer Banks Dementia Friendly Coalition

Coldwell Banker Seaside Realty is proud to donate $2,000 to the Outer Banks Dementia Friendly & Coalition and sponsor the Love to Remember Racquet Sports Tournament.

Thank you to Jan Collins to all she does for this organization! Still time to donate to the October 24-26 event.

August Top Producers

We’re thrilled to recognize the outstanding accomplishments of our top-producing Outer Banks agents at Coldwell Banker Seaside Realty.

Your dedication, market knowledge, and commitment to exceptional client service continue to define excellence across the Outer Banks real estate community. From helping buyers discover their perfect coastal home to guiding sellers toward successful results, you exemplify the professionalism and passion that drive our success.

Congratulations to our Top Agents for August — your achievements inspire us all and showcase the very best of Coldwell Banker Seaside Realty!

Agents of the Month:

Kill DevilHills: Melissa Morgan

Elizabeth City and Kitty Hawk: Haley Winslow

Teams of the Month:

Kill Devil Hills: The VanderMyde Group

Kitty Hawk: The Heather Sakers Team

Top Teams:

1. Heather Sakers Team

2. Vandermyde Group

3. Courtney & Johnny

4. The Garcia Team

5. The Sandman Team

Top Agents:

1. Haley Winslow

2. Melissa Morgan

3. Martin Griffin

4. Devin Fisher

5. Kent Copeland

Coldwell Banker Top July Agents

Congratulations to our Top Agents for July

We are proud to recognize the exceptional achievements of our top-producing Outer Banks agents at Coldwell Banker Seaside Realty. Their dedication, expertise, and unwavering commitment to client success continue to set the standard for excellence in our market. Whether helping buyers find their dream homes or guiding sellers to achieve the best results, these outstanding professionals embody the values and spirit of our company.

Congratulations to our top agents—you inspire us all with your hard work, passion, and remarkable results!

Top Teams:

#1. The VanderMyder Group

#2. The Heather Sakers Team

#3. The M&M Team

#4. The Garcia Team

#5. The Sandman Team

Top 5 Agents:

#1. Cameron Griggs

#2. Emily Bray

#3. Joanna Kane

#4. Devin Fisher

#5. Ann Taylor Hinton

Agent of the Month-Kill Devil Hills

Joanna Kane

Agent of the Month-Kitty Hawk

Cameron Griggs

Agent of the Month-Elizabeth City

Emily Bray

The Lost Colony 88th Season Opens May 29th, 2025

The Lost Colony 88th Season-Coldwell Banker Seaside Realty is a Proud Corporate Sponsor

The Lost Colony’s 88th season begins May 29th and runs through August 23rd, 2025. The show begins at 8:30 p.m., Monday through Saturday at Waterside Theatre on Roanoke Island. Tickets start at $25. For more information visit www.thelostcolony.org.

Dare Nights at The Lost Colony

Sponsored by Midgett Insurance, Dare Nights, which historically have been performances that Outer Banks locals may attend for free with donations to local food pantries, will take place on May 29th and May 30th. Make plans to arrive early to drop off donation items and receive your free tickets.

Dare Nights May 29th, 2025- Supports The Roanoke Island Food Pantry

Dare Nights May 30th, 2025- Supports The Beach Food Pantry

For more information: www.thelostcolony.org

Also returning for a fourth year is the popular free Native American Pre-Show, performed by indigenous members of the cast on Tuesday, Friday and Saturday nights.

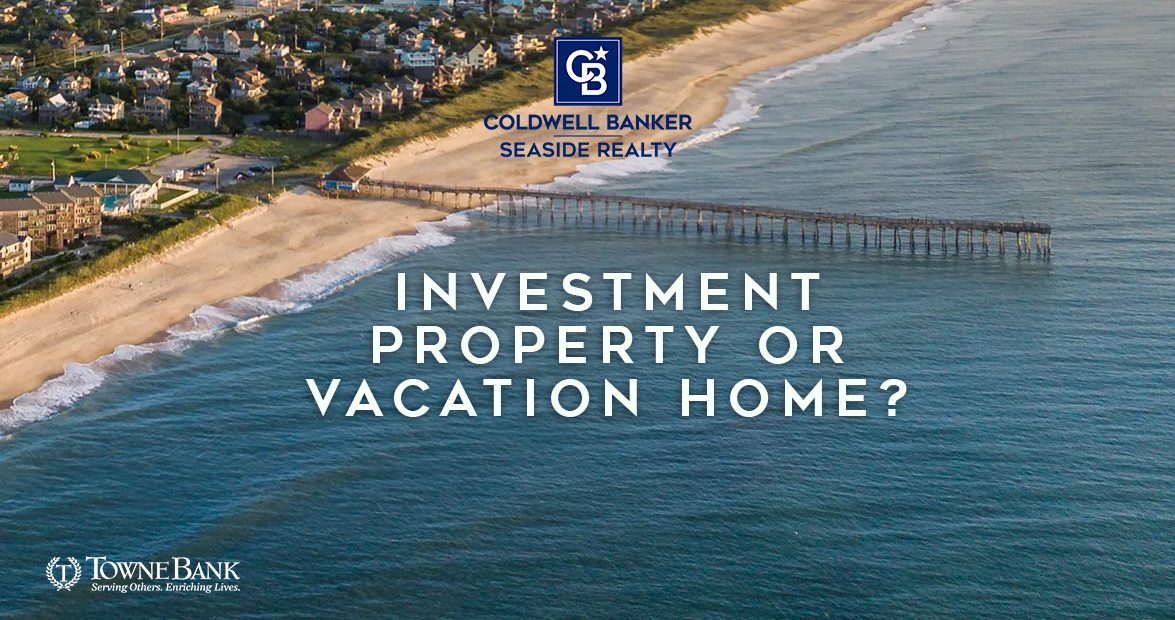

Investment Property or Vacation Home? Which One is Right for You

Investment Property or Vacation Home? Which One is Right for You

So, you’re thinking about finally investing in that beach house up for sale in your favorite resort town. But will it be your vacation home? Or will you use it as a rental property?

Maybe you’re planning on doing a little of both. Either way, purchasing a property can always be seen as a good long-term investment, whether you plan on generating rental income or not. However, mortgage lenders and the IRS will define your home as either a personal residence or investment property.

Here are some of the main differences between vacation homes and investment properties.

Vacation Homes

A vacation home, or second home, is a residence that you plan to occupy for part of the year. It’s typically used as a vacation home but could also be used as a property that you visit on a regular occasion—such as an apartment in a city you visit frequently for work. Typically, vacation homes must be located a certain distance from your home, or in a resort area, such as the Outer Banks of North Carolina.

A second home is a reasonable distance from your primary home. You must occupy the home some portion of the year and you cannot typically own another home in the same area.

Borrowers who want to purchase a vacation home must have enough income to qualify for monthly payments and will typically need a sizable downpayment.

The downpayment amount will vary depending on the loan type and the lender, so it’s best to speak with a loan officer about your situation when trying to determine how much is needed for your downpayment.

To qualify for a second home, a borrower must ensure that the home will be occupied only as a second home and that the property will be kept available for the borrower’s exclusive use and enjoyment. This means that the borrower cannot use the home solely as a time-share or rental home.

When purchasing a second home, your lender will want to ensure that the owner intends to occupy and control the home. Also, even if there is seasonal rental income on the home, you cannot use any rental income for qualifying.

This doesn’t mean you can’t rent out your vacation home on occasion, which is a common misconception.

Your vacation home is considered a dwelling unit if you use it for personal purposes for 14 days during a taxable year or use it 10 percent of the total days you rent it out to others.

For instance, if you occupy your vacation home for 20 days throughout the year, it is still considered as a vacation home—unless you rent it out more than 180 days throughout the taxable year. You should consult your tax advisor for more details.

In fact, borrowers may rent out their vacation home 14 days throughout the taxable year without reporting any income to the IRS. You cannot deduct expenses associated with renting the property, but can still deduct mortgage interest, real estate taxes and casualty and theft losses, according to the IRS.

Locally property management companies allow homeowners to be absentee owners but still have full control to use the property whenever they want for however long they would like. The property management company can help you keep track of rental usage and report it to the IRS.

Investment/Rental Homes

An investment property is not your primary residence, and it is purchased in order to generate income, profit from appreciation, or to take advantage of certain tax benefits.

An investment property is a true investment, purely for rental income or for clients who own multiple homes in the same area.

Borrowers purchasing an investment home will likely need to put more money down than they would for a second home. Under some circumstances, projected rental income can be used to help qualify the borrower for an investment property.

The biggest difference in qualifying for an investment property and vacation home is that the reserve assets needed on an investment property is greater, and rental income could be used to qualify for an investment property.

Rental properties allow for personal use, but it is limited to no more than 14 days or 10 % of the number of days it is rented out.

All rental income must be reported to the IRS. You can write off expenses from your rental homes, such as mortgage interest, property tax, operating expenses, depreciation, and repairs. You must, however, pay taxes on the profit that you earn on the rental property after expenses, according to the IRS.

Looking for more information on an investment property or second home?

Visit cbseaside.com and reach out to work with one of our exceptional agents!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link